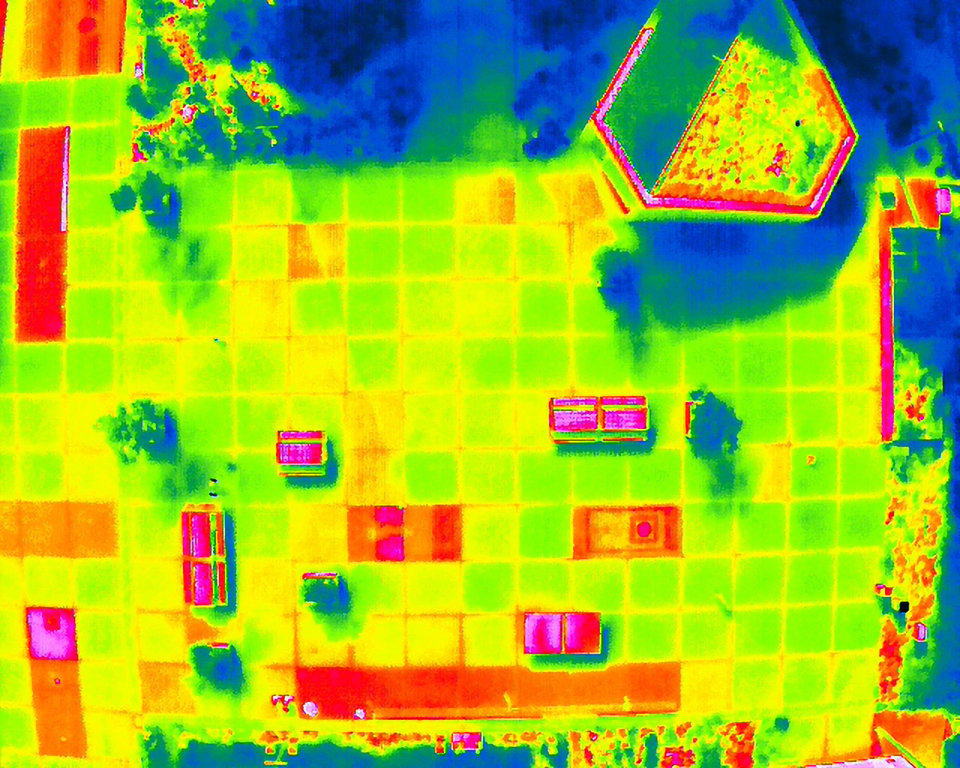

‘Software alone is not enough. You need machines.’

Investment company FORWARD.one is involved in various Delft-based spin-off companies. Its founder Arjan Göbel is an Offshore Engineering graduate of TU Delft and was a co-founder Ampelmann, which he helped grow into a successful company in the offshore industry. He subsequently began investing in high-tech hardware (aka deep tech): radical innovations based on breakthrough technology. What drives Göbel and why is he investing in start-up tech companies?

By Jurjen Slump • October 25, 2023

© Ampelmann

What made you start investing in deep tech?

‘When we founded FORWARD.one a mere seven years ago, people were not really into what we call high-tech hardware. Investors were queueing up for a share of software companies such as Airbnb and Uber. Yet, when it comes to the energy transition, you need hardware: solar panels, wind turbines, batteries and sensors. We were the only investor in the Netherlands that was considering start-ups of this kind.’

What kind of technology are we talking about?

‘It varies from chips for quantum computers (Quantware) to robotics for charging electric vehicles (Rocsys), and more efficient fermentation technology (DAB). And then there's climate tech such as Qualinx, a spin-off that makes GPS chips up to ten times more energy efficient. Hardware is the common denominator in all our investments. Software alone is not enough. There needs to be a physical component. You need machines. It must also have the potential to really disrupt things.’

Just do it! Arjen Göbel encourages entrepreneurial students to start a business © FORWARD.one

The companies you named all originated in Delft. Is this a coincidence?

‘Some of us are from Delft, so it’s no coincidence from that perspective. A distinguishing trait of people from Delft is that they really like to tinker. Take the Dream Hall, where teams of students build solar-powered and hydrogen-powered cars. These people are all doers who really get stuck into things. Their initial idea might be somewhat naive, but getting involved yourself has its advantages. I strongly believe that if you make a product yourself, it will ultimately turn out better. This approach was very successful at Ampelmann.’

Ampelmann makes safe, stable gangways for use in the offshore industry. You helped grow this business from a start-up to a flourishing company and then sold your part of it. What is the most important lesson you’ve learnt over all of these years?

‘Execution is far and away the most important thing. You must have a sense of urgency and get your product to market quickly. You must set yourself unrealistic deadlines and then make those deadlines. Techies often strive for perfection, but a B is good enough. Enter the market and generate your first revenue. This is also the only way to get feedback from customers, which in turn allows you to improve your product.’

'We were able to make extensive use of the university’s facilities while building our first prototype.'

You often work together with Delft Enterprises. What’s your view on universities investing in spin-offs?

‘I applaud it, especially in the early phase. The initial thousands of euros, assistance with patent applications, coaching – all of these things are very useful. For me personally, a university’s involvement in a start-up counts as a seal of approval. However, over the past few years, it hasn’t always been clear how big the shareholdings of the universities were in these enterprises. But the new deal terms have brought a lot more transparency and uniformity.

Besides this, I feel ploughing something back into the university is the decent thing for an entrepreneur to do. TU Delft meant a lot to Ampelmann. For instance, we were able to make extensive use of the university’s facilities while building our first prototype.’

What’s your view on the general investment landscape in the Netherlands?

‘It really is considerably better than seven years ago. The early phase following the establishment of new companies is well covered now. This is good news for entrepreneurs just starting out, but it suits us too because we like to invest jointly with other parties to spread the risks. What I do see though is that many businesses still go abroad when it comes to really large investment rounds. It would be good if this issue got more attention here. If we managed to keep these companies here, it would immediately result in jobs that would otherwise have gone to the US.’

What drives you as an investor?

‘Being a driver of innovation! Venture capital results in new products that would otherwise not have existed. We literally create jobs . Our ambition is to keep businesses in the Netherlands for longer. To this end, we are working on larger funds to allow us to invest in companies that are set to grow very vigorously and will need lots of money to facilitate this growth. If this enables us to attract and retain good entrepreneurs, it will be mutually reinforcing. Turning the flywheel is how I would put it.’

And personally?

‘I quite enjoy being involved in innovation. All entrepreneurs are convinced that they will conquer the world within ten years. They approach their business with 100% conviction. It’s a lovely bubble to be in. I also see this drive among today’s students. In my day, everyone wanted a job at Shell; nowadays they all want to work at Van Oord so they can build offshore wind turbines. I get a really positive feeling from this.’

What would you say to enterprising students who are considering starting a business?

‘Just do it. There’s time enough to get a job in the corporate world. TU Delft graduates don’t need to worry about employment. As a newly qualified engineer, you are still unencumbered by a mortgage or children, which makes it a lot easier to start a business. So just do it. Attract people with good commercial skills and never lose the sense of urgency!’

![[Translate to English:] [Translate to English:]](https://filelist.tudelft.nl/_processed_/8/3/csm_NoordzeeWind%20wind%20farm%2C%20Netherlands_169_resized_5bc0ad6e0e.jpg)